Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted byRule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to |

Invuity, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| Invuity, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. | |||

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: | |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |||

(4) | Proposed maximum aggregate value of transaction: | |||

(5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: | |||

(3) | Filing Party: | |||

(4) | Date Filed: | |||

Notice of Annual Meeting of Stockholders to be Held May 19, 2016June 12, 2017

Dear Stockholders:

You are cordially invited to attend our 20162017 Annual Meeting of Stockholders, or the Annual Meeting, which will be held at the headquarters of Invuity, Inc., located at 444 De Haro Street, San Francisco, CA 94107, on Thursday, May 19, 2016,Monday, June 12, 2017, at 3:10:00 p.m.a.m., local time.

We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying Proxy Statement:

All of our stockholders of record as of March 23, 2016,April 17, 2017, are entitled to attend and vote at the Annual Meeting and at any adjournment or postponement of the Annual Meeting.

Our board of directors recommends that you voteFOR the election of each of the director nomineesnominee named in Proposal 1 andFOR the ratification of the appointment of our independent registered public accounting firm as provided in Proposal 2.

Your vote is very important.important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section entitled “"How can I vote my shares?”" in this Proxy Statement or, if you requested to receive printed proxy materials, the enclosed proxy card.

By Order of the Board of Directors

Sincerely,

Philip Sawyer

President and Chief Executive Officer

San Francisco, California

April 28, 2017

April 8, 2016

Approximate Date of Mailing of Notice of Internet Availability of Proxy Materials: April 8, 2016May 1, 2017

| Page | ||||

|---|---|---|---|---|

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING | ||||

| PROPOSAL 1: ELECTION OF DIRECTORS | 7 | |||

| 7 | |||

| 7 | ||||

| 8 | |||

| 9 | ||||

| 11 | |||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

|

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 28 | |||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | |||

| 37 | |||

| 37 | |||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | |||

| 38 | ||||

-i-

2016

2017 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2016JUNE 12, 2017

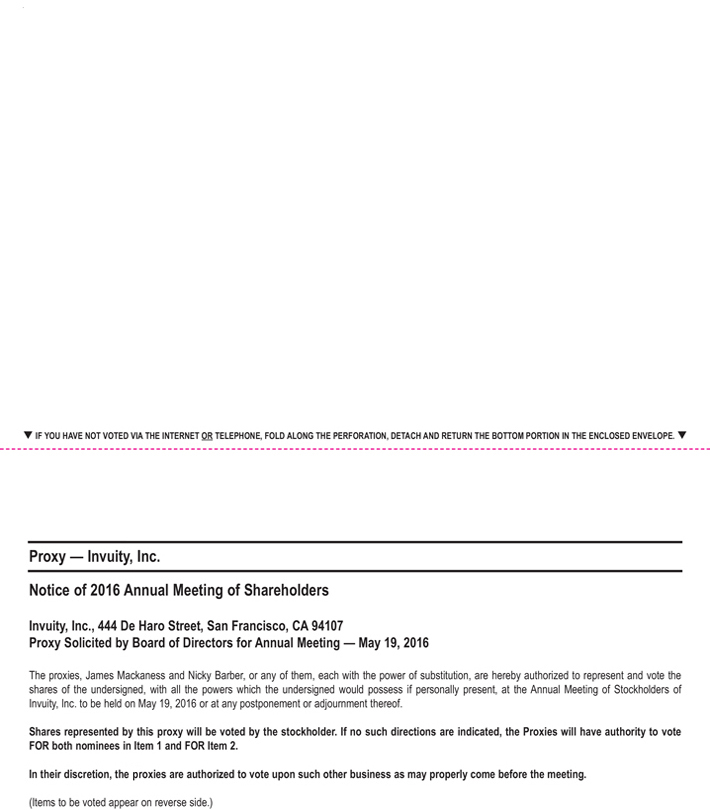

Our board of directors is soliciting proxies for use at our 2016 annual meeting2017 Annual Meeting of stockholders,Stockholders, or the Annual Meeting, to be held on Thursday, May 19, 2016,Monday, June 12, 2017, at 3:10:00 p.m.a.m., local time, at the headquarters of Invuity, Inc., located at 444 De Haro Street, San Francisco, CA 94107. Invuity, Inc. is sometimes referred to herein as “we”"we", “us”"us", “our”"our" or the “Company.”"Company."

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

The following questions and answers are intended to briefly address potential questions that our stockholders may have regarding this Proxy Statement and the Annual Meeting. They are also intended to provide our stockholders with certain information that is required to be provided under the rules and regulations of the Securities and Exchange Commission, or the SEC. These questions and answers may not address all of the questions that are important to you as a stockholder. If you have additional questions about the Proxy Statement or the Annual Meeting, please see the response to the question entitled “"Whom shall I contact with other questions ?”?" below.

| Q: | What is the purpose of the Annual Meeting? |

| | | |

A: | At the Annual Meeting, our stockholders will be asked to consider and vote upon the matters described in this Proxy Statement and in the |

| accompanying Notice of Annual Meeting of Stockholders, and any other matters that properly come before the Annual Meeting. |

Q: | When and where will the Annual Meeting be held? |

| | | |

A: | You are invited to attend the Annual Meeting on |

| headquarters located at 444 De Haro Street, San Francisco, CA 94107. |

Q: | Why did I receive these proxy materials? |

| | | |

A: | We are making these proxy materials available in connection with the solicitation by our board of directors of proxies to be voted at the Annual Meeting, and at any adjournment or postponement thereof. Your proxy is being solicited in connection with the Annual Meeting because you owned our common stock at the close of business on | |

You are invited to attend the Annual Meeting in person to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may vote your shares as described in the response to the question entitled "How can I vote my shares" below and as described elsewhere in this Proxy Statement. | ||

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible. |

You are invited to attend the Annual Meeting in person to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may vote your shares as described in the response to the question entitled “How can I vote my shares” below and as described elsewhere in this Proxy Statement.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible.

| Q: | Why did I receive a notice in the mail regarding the Internet availability of proxy materials? |

| | | |

A: | Instead of mailing printed copies of our proxy materials to each of our stockholders, we have elected to provide access to them over the Internet under the |

| stockholders aware of the Annual Meeting and the availability of our proxy materials by sending a Notice of Internet Availability of Proxy Materials, or a Notice, which provides instructions for how to access the full set of proxy materials through the |

-1-

| Internet or make a request to have printed proxy materials delivered by mail. Accordingly, on or about |

| www.invuity.com. The Notice also provides instructions on how to vote your shares through the Internet or by telephone. |

We believe compliance with the SEC’s “notice and access” rules will allow us to provide our stockholders with the materials they need to make informed decisions, while lowering the costs of printing and delivering those materials and reducing the environmental impact of our Annual Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice.

We believe compliance with the SEC's "notice and access" rules will allow us to provide our stockholders with the materials they need to make informed decisions, while lowering the costs of printing and delivering those materials and reducing the environmental impact of our Annual Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice. | ||

Q: | What proposals will be voted on at the Annual Meeting? |

| | | |

A: | The proposals to be voted on at the Annual Meeting, and our board of |

| Proposal |

| Board's Voting

| |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Election of Directors

| FOR | |||||||||

• Eric Roberts | |||||||||||

2. | Ratification of the Appointment of Independent Registered Public Accounting Firm | FOR | |||||||||

Q: |

We will also consider any other business that properly comes before the Annual Meeting. As of the record date, we are not aware of any other matters to be submitted for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons

named in the enclosed proxy card or voter instruction card will vote the shares they represent using their best judgment. James H. Mackaness and Daniel E. Caul, the designated proxyholders, are members of our management.

Who may vote at the Annual Meeting? |

| | | |

A: | If you owned our common stock on |

| of common stock held on all matters to be voted on. On the record date, there were |

-2-

| Q: | What is the quorum requirement for the Annual Meeting? |

| | | |

A: | We need a quorum of stockholders in order to hold our Annual Meeting. A quorum exists when at least a majority of the outstanding shares of our common stock entitled to vote as of the record date, or |

| represented at the Annual Meeting, either in person or by proxy. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained. |

-2-

Q: | What vote is required to approve each proposal? |

| | | |

A: | Election of Directors (Proposal 1): Directors will be elected by a plurality of the votes cast, so the |

Ratification of the Appointment of Independent Registered Public AccountingFirm (Proposal 2): The ratification of the

appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting.

Ratification of the Appointment of Independent Registered Public Accounting Firm (Proposal 2): The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting. | ||

Q: | What is the difference between a |

| | | |

A: | You are considered to be a stockholder of record if your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., on the record date. |

If, however, your shares are held in a brokerage account or by a bank or other agent, and not in your name, you are considered to be the beneficial owner of shares held in street name.

If you are the beneficial owner of shares held in street name, you are welcome to attend the Annual Meeting, but you may not vote your shares in person at the Annual Meeting unless you bring with you a proxy from the broker, bank or other agent that holds your shares, giving you the right to vote at the Annual Meeting.

Admission to the Annual Meeting will be on a first-come, first-served basis. You should be prepared to present government-issued photo identification for admittance, such as a passport or driver’s license. Please note that for security reasons, you and your bags may be subject to search prior to your admittance to the Annual Meeting. If you do not comply with each of the foregoing requirements, you will not be admitted to the Annual Meeting.

Q: |

If you are a beneficial owner of shares held in street name and do not provide the entity that holds your shares with specific voting instructions, the entity that holds your shares may generally vote at its discretion on “routine” matters. However, if the entity that holds your shares does not receive instructions from you on how to vote your shares on a “non-routine” matter, it will be unable to vote your shares on that matter. This is generally referred to as a “broker non-vote.”

The ratification of the appointment of PricewaterhouseCoopers LLP as our

independent registered public accounting firm (Proposal 2) is considered a routine matter under applicable rules. A broker or other nominee may generally vote without instructions on this matter, so there will not be any broker non-votes in connection withProposal 2.

-3-

A broker non-vote occurs when a broker, bank or other agent holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. Shares represented by proxies that reflect a broker non-vote will be counted for purposes of determining the presence of a quorum. The election of directors (Proposal 1) is considered a non-routine matter and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote. The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm (Proposal 2) is considered a routine matter on which a broker, bank or other agent has discretionary authority to vote, so there will not be any broker non-votes in connection with this proposal.

How can I vote my shares? |

| | | |

A: | With respect to the election of directors (Proposal 1), you may either vote |

The procedures for voting are as follows:

If you are a stockholder of record, you may vote in person at the Annual Meeting. Alternatively, you may vote by proxy through the Internet, by phone or using the accompanying proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote in person if you have already voted by proxy.

To vote in person, come to the Annual Meeting and you may request a ballot when you arrive.

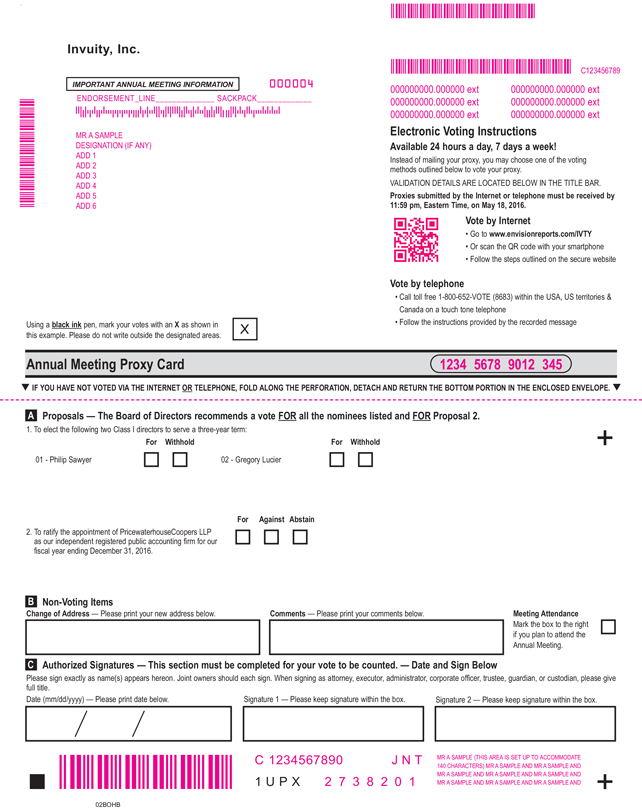

To vote on the Internet, go towww.envisionreports.com/IVTY and follow the instructions provided on the website. In order to cast your vote, you will be asked to provide the control number from the Notice or, if you requested to receive printed proxy materials, the proxy card mailed to you. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on May 18, 2016.June 11, 2017. Our Internet voting procedures are designed to

authenticate stockholders by using individual control numbers, which are located on the Notice.

To vote by phone, call toll-free 1-800-652-VOTE(1-800-652-8683) if calling from the United States, U.S. territories and Canada or 1-781-575-2300 if

calling from foreign countries from any touch-tone telephone and follow the instructions. In order to cast your vote, you will be asked to provide the control number from the Notice or, if you requested to receive printed proxy materials, the proxy card mailed to you. Telephonic voting is

-3-

available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on May 18, 2016.June 11, 2017. Our telephonic voting procedures are designed to authenticate stockholders by using individual control numbers, which are located on the Notice.

To vote using the proxy card, simply complete, sign and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. If you received a Notice and would like to request a proxy card by mail, please follow the instructions contained in the Notice.

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice or a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply follow the instructions in the Notice received from your

-4-

broker, bank or other agent to vote on the Internet or, if you received a proxy card by mail, complete, sign and return the proxy card to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or

other agent. Follow the instructions from your broker, bank or other agent included in the Notice or with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

| Q: | How may I revoke or change my vote after submitting my proxy? |

| | | |

A: | You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. |

If you are a stockholder of record, you may revoke your proxy in one of the four following ways:

|

Your most current Internet proxy or proxy card will be the one that is counted at the Annual Meeting.

If you are a beneficial owner of shares, you may

revoke your proxy by following instructions provided by your broker, bank or other agent.

| Q: | May I vote my shares in person at the Annual Meeting? | |

| | | |

A: | If you are the stockholder of record, you have the right to vote in person at the Annual Meeting. When you arrive at the Annual Meeting, you may request a ballot. | |

If you are the beneficial owner of shares held in street name, you are welcome to attend the Annual Meeting, but you may not vote your shares in person at the Annual Meeting unless you bring with you a proxy from the broker, bank or other agent that holds your shares, giving you the right to vote at the Annual Meeting. |

-4-

| Admission to the Annual Meeting will be on a first-come, first-served basis. You should be prepared to present government-issued photo identification for admittance, such as a passport or driver's license. Please note that for security reasons, you and your bags may be subject to search prior to your admittance to the Annual Meeting. If you do not comply with each of the foregoing requirements, you will not be admitted to the Annual Meeting. | ||

Q: | What happens if I do not give specific voting instructions? | |

| | | |

A: | If you are a stockholder of record and you indicate when voting that you wish to vote as recommended by our board of directors, or if you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares as recommended by our board of directors on all matters presented in this Proxy Statement, and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. | |

If you are a beneficial owner of shares held in street name and do not provide the entity that holds your shares with specific voting instructions, the entity that holds your shares may generally vote at its discretion on "routine" matters. However, if the entity that holds your shares does not receive instructions from you on how to vote your shares on a "non-routine" matter, it will be unable to vote your shares on that matter. This is generally referred to as a "broker non-vote." | ||

Q: | Which proposals in this Proxy Statement are considered "routine" or "non-routine" matters? | |

| | | |

A: | The election of directors (Proposal 1) is considered a non-routine matter under applicable rules. As a result, a broker or other nominee may not vote without instructions on this matter, so there may be broker non-votes onProposal 1. | |

The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm (Proposal 2) is considered a routine matter under applicable rules. A broker or other nominee may generally vote without instructions on this matter, so there will not be any broker non-votes in connection withProposal 2. | ||

Q: | What is the effect of abstentions and broker non-votes? | |

| | | |

A: | Shares held by persons attending the Annual Meeting but not voting, and shares represented by proxies that reflect abstentions as to a particular proposal, will be counted as present for purposes of determining the presence of a quorum. Abstentions are treated as shares present in person or by proxy and entitled to vote. The election of directors (Proposal 1) will be determined by a plurality of votes cast, so abstentions on this Proposal will not have an effect on the outcome of this vote. The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm (Proposal 2) requires the affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting, so abstentions on this Proposal will have the same effect as a vote against this proposal. | |

A broker non-vote occurs when a broker, bank or other agent holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. Shares represented by proxies that reflect a broker non-vote will be counted for purposes of determining the presence of a quorum. The election of directors (Proposal 1) is considered a non-routine matter and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote. The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm (Proposal 2) is considered a routine matter on which a broker, bank or other agent has discretionary authority to vote, so there will not be any broker non-votes in connection with this proposal. |

-5-

| Q: | Who solicits the proxies and what is the cost of this proxy solicitation? |

| | | |

A: | We will pay all of the costs of soliciting these proxies. Our directors, officers and other employees may solicit proxies in person or by telephone, mail, fax and email, but will be paid no additional compensation for these services. We have also engaged The Proxy Advisory Group, LLC to assist in the solicitation of proxies and to provide related advice and informational support, for a services fee and the reimbursement of customary disbursements that are not expected |

| to exceed |

Q: | Where can I find voting results of the Annual Meeting? |

| | | |

A: | In accordance with SEC rules, final voting results will be published in a Current Report on Form 8-K within four business days following the Annual Meeting, unless final results are not known at that |

| time in which case preliminary voting results will be published within four business days of the Annual Meeting and final voting results will be published once they are known by us. |

Q: | Whom should I contact with other questions? |

| | | |

A: | If you have additional questions about this Proxy Statement or the Annual Meeting, or if you would like additional copies of this Proxy Statement, please contact: Invuity, Inc., 444 De Haro Street, San Francisco, CA 94107, Attention: Chief Financial Officer, Telephone: (415) 655-2100. |

please contact: Invuity, Inc., 444 De Haro Street, San Francisco, CA 94107, Attention: Chief Financial Officer, Telephone: (415) 655-2100.-6-

PROPOSAL 1: ELECTION OF DIRECTORS

Board Structure |

Our business is managed under the direction of our board of directors, which currently consists of six directors. Effective immediately prior to the Annual Meeting, the size of our board of directors will be reduced from six to five members. Our directors hold office until the earlier of their death, resignation, removal, or disqualification, or until their successors have been elected and qualified. Our board of directors is divided into three classes with staggered three-year terms. At each annual meetingAnnual Meeting of stockholders,Stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election or until their earlier death, resignation or removal. Our directors are divided among the three classes as follows:

Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in control of our company.

At December 31, 2015, our board of directors consisted of seven members. Upon the resignation of Dr. Brown effective that same date, Class I consisted of one director and one vacancy, Class II consisted of two directors and Class III consisted of three directors. On March 23, 2016, our board of directors completed a process to re-align its members into three classes of nearly equal size. In order to facilitate this process, Gregory T. Lucier agreed to change from a Class III member of our board of directors to a Class I member of our board of directors. To effect this change, Mr. Lucier resigned as a Class III director and was immediately re-appointed to our board of directors as a Class I director. Immediately following the appointment of Mr. Lucier as a Class I director, the board reduced the size of the board from seven members to six members and eliminated the vacancy in Class III.

Election of Directors |

At the Annual Meeting, our stockholders are being asked to vote for the Class III director nomineesnominee listed below to serve on our board of directors until our annual meeting in 20192020 Annual Meeting of Stockholders and until each of their successorshis successor has been elected and qualified, or until such director’sdirector's death, resignation or removal. Each of these nomineesThe nominee is a current member of our board of directors, whose term expires at the Annual Meeting. Each of these nomineesThe nominee has consented to serve, if elected.

Provided that a quorum of stockholders is present at the Annual Meeting, directors will be elected by a plurality of the votes cast by the stockholders entitled to vote on this proposalProposal at the Annual Meeting. Abstentions, broker non-votes and votes withheld will not be treated as votes cast for this purpose and, therefore, will not affect the outcome of the election.

If no contrary indication is made, proxies will be voted for the nominees,nominee, or, in the event that anythe nominee is not a candidate or is unable to serve as a director at the time of the election, for any nominee who is designated by our board of directors to fill the vacancy.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE DIRECTOR NOMINEE

-7-

|

Nominee for Director |

The following table lists the personsperson recommended by the nominating and corporate governance committee of our board of directors and nominated by our board of directors to be elected as directors,a director, including relevant information as of April 1, 201615, 2017 regarding his age, business experience, qualifications, attributes, skills and other directorships:

Nominee for Election to the Board of Directors

For a Three-Year Term Expiring at the 2020 Annual Meeting of Stockholders

(Class II Director)

| Eric Roberts Director Age: 53 Director since: 2012 | Mr. Roberts has served as a member of our board of directors since June 2012. Since January 2012, Mr. Roberts has been a founding Managing Director of Valence Life Sciences. Since June 2006, Mr. Roberts has been a founding Managing Director of Caxton Advantage Venture Partners. From 1986 to 2004, Mr. Roberts served in a variety of roles as an investment banker, including as Managing Director and Partner at Dillon, Read & Co. and Managing Director and Co-Head of the Healthcare Investment Banking Group at Lehman Brothers. Mr. Roberts serves on the board of directors of VIVUS, Inc., a publicly traded biopharmaceutical company. Mr. Roberts received a B.S. in economics from the Wharton School of the University of Pennsylvania. We believe Mr. Roberts is qualified to serve as a member of our board of directors because of his experience as an investment banker and venture capitalist in the healthcare industry. |

-8-

Members of the Board of Directors Continuing in Office |

The following table lists the members of our board of directors that are continuing in office, including relevant information as of April 15, 2017 regarding their age, business experience, qualifications, attributes, skills and other directorships:

Nominees for Election to the Board of Directors

For a Three-Year Term Expiring at the 20192020 Annual Meeting of Stockholders

(Class I Directors)

Philip Sawyer

52 | Mr. Sawyer has served as our Chief Executive Officer and a member of our board of directors since March 2010 and as our President since June 2012. In 2008, Mr. Sawyer co-founded Helix Ventures, a healthcare venture capital fund. In 1993, Mr. Sawyer co-founded Fusion Medical Technologies, a surgical sealant company, where he held the positions of President and Chief Executive Officer for nine years, guiding the company through two private financings, an initial public offering and an acquisition by Baxter International. Mr. Sawyer worked in marketing and business development at Stryker Corporation from 1991 to 1993. Mr. Sawyer received a B.A. in political science from Haverford College and an M.B.A. from Harvard Business School.

|

Gregory

52 | Mr. Lucier has served as a member of our board of directors since October 2014 and as the Chairman of our board of directors since December 2015. Since May 2015, Mr. Lucier has served as the Chief Executive Officer of NuVasive, a publicly traded medical device company. From November 2008 to February 2014, Mr. Lucier was Chairman of the board of directors and Chief Executive Officer of Life Technologies, a global life sciences company acquired by Thermo Fisher Scientific in 2014. In May 2003, Mr. Lucier joined Life

|

-9-

-7-

Table of the Board of Directors Continuing in OfficeContents

The following table lists the members of our board of directors that are continuing in office, including relevant information as of April 1, 2016 regarding their age, business experience, qualifications, attributes, skills and other directorships:

Term Expiring at the 20172018 Annual Meeting of Stockholders

(Class IIIII Directors)

William Burke

57 | Mr. |

| Randall Lipps Director Age: 59 Director since: 2013 | Mr. Lipps has served as a member of our board of directors since June Southern Methodist University. We believe Mr. |

-10-

Member of the Board of Directors Not Continuing in Office |

Term Expiring at the Annual Meeting

(Class II Director)

The following table lists the member of our board of directors whose term expires at the Annual Meeting and is not standing for re-election, including relevant information as of April 15, 2017 regarding his age, business experience, qualifications, attributes, skills and other directorships:

| Reza Zadno, Ph.D. Director

Age: 62 Director since: 2013 | Dr. Zadno has served as a member of our board of directors since January 2013. From September 2016, Dr. Zadno served as the chief executive officer at Avedro Inc., an InterWest Partners portfolio company and ophthalmic pharmaceutical and medical device company. From July 2016 to August 2016, Dr. Zadno served as interim chief executive officer at Avedro. Since January 2015, Dr. Zadno has served as an Innovation Advisor to Novartis Venture Fund and has served as an Executive in Residence at InterWest Partners, a venture capital firm, where he served as a Venture Partner from January 2012 to December 2014. From January 2011 to January 2012, Dr. Zadno served as a Venture Partner at New Leaf Venture Partners, a venture capital firm. From March 2001 to September 2009, Dr. Zadno was founder, President, and Chief Executive Officer of Visiogen, a medical device company, which was acquired by Abbott-Medical Optics, a medical supply company, in 2009, at which time Dr. Zadno served as its General Manager until January 2011. From August 2000 to March 2001, Dr. Zadno worked as Entrepreneur in Residence at Three Arch Partners, a healthcare investment firm. Dr. Zadno currently serves on the board of directors of Autonomic Technologies, Carbylan Therapeutics and Gobiquity. Dr. Zadno received a Ph.D. (Docteur-Ingenieur) in Mechanical Properties of Materials from Ecole des Mines de Paris.

|

-11-

-8-

Term Expiring at the 2018 Annual Meeting of Stockholders

(Class III Directors)Table of Contents

|

|

|

|

-9-

Director Independence |

Under the rules of the NASDAQ Global Market, independent directors must comprise a majority of a listed company’scompany's board of directors. In addition, the rules of the NASDAQ Global Market require that, subject to specified exceptions, each member of a listed company’scompany's audit, compensation and nominating and corporate governance committees be

independent. Our board of directors has assessed the independence of each director and determined that Dr. Zadno and Messrs. Burke, Lipps, Lucier and Roberts are independent. We believe that the composition of our board of directors meets and will meet the requirements for independence under the current requirements of the NASDAQ Global Market.

Family Relationships |

There are no family relationships between any director, executive officer or person nominated to become a director or executive director.

Agreements with Directors |

None of the directors or nomineesthe nominee for director was selected pursuant to any arrangement or understanding, other than with the directors of the Company acting within their capacity as such.

Legal Proceedings with Directors

Legal Proceedings with Directors |

There are no legal proceedings related to any of the directors or the director nomineesnominee which require disclosure pursuant to Items 103 or 401(f) of Regulation S-K.

Board Leadership Structure |

The positions of chairman of the board and chief executive officer are presently separated. We believe that separating these positions allows our chief executive officer to focus on our day-to-day business, while allowing the chairman of the board to lead our board of directors in its fundamental role of providing advice to and independent oversight of management. Our board of directors recognizes the time, effort and energy that the chief executive officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our chairman, particularly as our board of

directors’ directors' oversight responsibilities continue to grow. While our board of directors does not have a formal policy on whether the roles of chief executive officer and chairman of our board of directors should be separate, our board of directors believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Currently, the independent chairman position is held by Gregory T. Lucier and our president and chief executive officer is Philip Sawyer.

Board Role in Risk Oversight |

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including risks relating to our operations and strategic direction.

-12-

Management is responsible for the day-to-day management of risks we face, while our board of directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board of directors has the responsibility to satisfy itself that the risk management

processes designed and implemented by management are adequate and functioning as designed.

The role of our board of directors in overseeing the management of our risks is conducted primarily through committees of our board of directors, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees. The full board of directors (or the

-10-

appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management our major risk exposures, their potential impact on us, and the steps we take to manage them. When a board committee is

responsible for evaluating and overseeing the management of a particular risk or risks, the chairman of the relevant committee reports on the discussion to the full board of directors during the committee reports portion of the next board meeting.

Board and Committee Meetings |

During 2015,2016, our board of directors met nine times (including telephonic meetings). Each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he has been a director and (ii) the total number of meetings held while he was a director, either in person or by teleconference.

Additionally, each director attended at least 75%all committees of the meetings for each committeeour board of directors on which he served except Gregory T. Lucier did not attend one ofduring the two meetings held by the nominating and corporate governance committee.

periods that he served.

Director Attendance at Annual Meetings

Director Attendance at Annual Meetings |

Although we do not have a formal policy regarding attendance by members of our board of directors at

our annual meetings of stockholders, we encourage all of our directors to attend.

Five directors attended our 2016 Annual Meeting of Stockholders.

Executive Sessions |

As required by the NASDAQ Global Market, our independent directors meet in regularly scheduled

executive sessions at which only independent directors are present.

Board Committees |

Our board of directors has three standing committees: the audit committee, the compensation committee, and the nominating and corporate governance committee. In addition, from time to time, special committees may be established under the direction of our board of directors when necessary to address specific issues. For instance, at the time of theeach of our initial public offering and our follow-on offering, we established a pricing committee to determine the offering price and other terms of each of the

initial public offering. offerings. At present, no special committees have been established.

Directors are expected to attend all scheduled board and committee meetings and conduct advance review of board and committee meeting materials.

Each of the three standing committees has a written charter that has been approved by our board of directors. A copy of each charter is available on our website atwww.invuity.com.

-13-

Audit Committee |

During 2015,2016, our audit committee met tenfive times (including telephonic meetings). Our audit committee is currently comprised of Dr. Zadno and Messrs. Burke and Roberts. Immediately prior to the Annual Meeting, Dr. Zadno will step down from the audit committee and Mr. Lucier will replace Dr. Zadno as a member of the audit committee immediately following the Annual Meeting. As such, following the Annual Meeting and contingent upon the re-election of Mr. Roberts, serve on our audit committee.committee will be comprised of Messrs. Burke, Lucier and Roberts. Mr. Burke serves as chair of the audit committee and is the audit committee’scommittee's financial expert within the meaning of the regulations of the SEC. Our board of directors has assessed whether all members of the audit committee meet the composition requirements of the NASDAQ Global Market, including the requirements regarding financial literacy and financial sophistication. Our board of directors found that Dr. Zadno and Messrs. Burke, Lucier and Roberts met these requirements and are independent

under SEC and the NASDAQ Global Market rules. The audit committee’scommittee's primary responsibilities include:

-11-

Compensation Committee

During 2015,2016, our compensation committee met three times (including telephonic meetings). Our compensation committee is currently comprised of Messrs. Lipps, Lucier and Roberts. Immediately prior to the Annual Meeting, Mr. Roberts serve on ourwill step down from the compensation committee. As such, following the Annual Meeting, the compensation committee will be comprised of Messrs. Lipps and Lucier. Mr. Lipps serves as the chair of the compensation committee. Our board of directors has assessed whether all members of our compensation committee meet the composition requirements of the NASDAQ Global Market. Our board of directors found that Messrs. Lipps, Lucier and Roberts met these requirements and are independent under SEC and the NASDAQ Global Market rules. The compensation committee’scommittee's responsibilities include:

-14-

From time to time, the compensation committee may use outside compensation consultants to assist it in analyzing our compensation programs and in determining appropriate levels of compensation and benefits.

Nominating and Corporate Governance Committee

Nominating and Corporate Governance Committee |

During 20152016 our nominating and corporate governance committee met two timesone time (including telephonic meetings). Our nominating and corporate governance committee is currently comprised of Dr. Zadno and Messrs. Burke and Lipps serve onLipps. Immediately prior to the Annual Meeting, Dr. Zadno will step down from the nominating and corporate governance committee and, contingent upon his re-election, Mr. Roberts will replace Dr. Zadno as a member of the nominating and corporate governance committee following the Annual Meeting. As such, following the Annual Meeting and contingent upon the re-election of Mr. Roberts, our nominating and corporate governance committee.committee will be comprised of Messrs. Burke, Lipps and Roberts. Mr. Burke serves as the chair of the nominating and corporate governance committee. Our board of directors has assessed whether all members of our nominating and corporate governance committee meet the composition requirements of the NASDAQ Global Market. Our board of directors found that Dr. Zadno and Messrs. Burke, Lipps and LippsRoberts met these requirements and are independent under SEC and the NASDAQ Global Market rules. The nominating and corporate governance committee’scommittee's responsibilities include:

Compensation Committee Interlocks and |

Insider Participation

-12-

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive

officers serving as a member of our board of directors or its compensation committee. None of the current members of the compensation committee of our board of directors has ever been one of our employees.

Director Nomination Process |

The goal of our nominating and corporate governance committee, which we refer to as the committee for purposes of this section, is to assemble a well-rounded board of directors that consists of directors with backgrounds that are complementary to one another, reflecting a variety of experiences, skills and expertise.

-15-

In considering whether to recommend any candidate for inclusion in the slate of recommended nominees for our board of directors, including candidates recommended by stockholders, the committee reviews with our board of directors the qualifications for director candidates as set forth in our corporate governance guidelines.

Directors must possess the highest personal and professional ethics, integrity and values. Necessary qualifications may include: the ability to make independent judgments, general understanding of the Company’sCompany's business, other board service, professional background, education and diversity.

While we do not have a policy regarding board diversity, it is one of a number of factors that the committee takes into account in identifying nominees.

The committee believes it is appropriate for our President and Chief Executive Officer to serve as a member of our board of directors.

The committee currently has a policy of evaluating nominees recommended by stockholders in the same manner as it evaluates other nominees. We do not intend to treat stockholder recommendations in any manner different from other recommendations. Under our amended and restated bylaws, stockholders wishing to propose a director nominee should send the proper written notice to our corporate secretary at the principal executive offices of the company. To be timely for our annual meeting2018 Annual Meeting of stockholders to be held in 2017,Stockholders, a stockholder’sstockholder's notice must be received by the corporate secretary no later than February 22, 2017March 17, 2018 and no earlier than January 23, 2017.February 15, 2018. We have not received director candidate recommendations from our stockholders.

Code of Business Conduct and Ethics

Code of Business Conduct and Ethics |

Our board of directors has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. Our code of business conduct and ethics is available on our

website atwww.invuity.com. We intend to disclose any amendments to the code, or any waivers of its requirements, on our website to the extent required by the applicable rules and exchange requirements.

Stockholder Communications with our Board of Directors

Stockholder Communications with our Board of Directors |

Stockholders seeking to communicate with our board of directors, as a whole, may send such communication to: Invuity, Inc., 444 De Haro Street, San Francisco, CA 94107, Attention: Chief Financial Officer. Stockholders seeking to communicate with an individual director, in his or her capacity as a member of our board of directors, may send such

communication to the same address to the attention of such individual director. We will promptly forward any such stockholder communication to each director to whom such stockholder communication is addressed to the address specified by each such director.

-16-

Under our outside director compensation programpolicy for fiscal year 2015,2016, each of our non-employee directors received compensation for his or her service consisting of annual cash retainers and certain of our non-employee directors received equity awards, as noted below. Accordingly, Mr. Sawyer, an executive officer of the Company, is not eligible for awards under our outside director compensation policy. We also reimburse our non-employee directors for expenses associated with attending board and committee meetings.

Our board of directors has not yet approved an outside director compensation program for fiscal year 2016.

Cash Compensation |

Since our initial public offering, non-employeeNon-employee directors receivedare eligible to receive the following cash compensation for their services:

All cash payments to non-employee directors were paid quarterly in arrears on a prorated basis.

Equity Compensation |

Non-employee directors are eligible to receive all types of equity awards (except incentive stock options) under our 2015 Equity Incentive Plan, or the 2015 Plan, (or the applicable equity plan in place at the time of grant) including discretionary awards not covered under our outside director compensation policy. All grants of awards under our outside director compensation policy will be automatic and nondiscretionary.

In April 2015, our boardSubject to the terms of directors approved option grantsthe outside director compensation policy, on the date of each Annual Meeting of Stockholders, each non-employee director will receive an equity award having a grant date fair value equal to purchase 10,810 shares$125,000, or the Annual Award. The Annual Award will be comprised of our common stock to Mr. Robertsoptions and 4,054 shares of our commonrestricted stock to Mr. Lucier. These options have an exercise price of $11.10 per share, theunits, or RSUs, each having a grant date fair market value of our common stock as determined by our board of directors on the grant date. The option granted to Mr. Roberts vests as toapproximately 50% of the underlying shares on April 16, 2015,aggregate value of the dateAnnual Award. Each stock option award granted at the 2016 Annual Meeting of grant, and the remaining 50% vests as to 1/24th per month over the following 24 months, subject to continued service through such date. The option granted to Mr. Lucier vestsStockholders will vest as to 100% of the underlying shares on April 16, 2015,subject thereto upon the datefirst annual anniversary of grant.

In May 2015, our board of directors approved an option grant to purchase 44,306 shares of our common stock to Mr. Burke. This option has an exercise price of $15.91 per share, the fair market value of our common stock as determined by our board of directors on the grant date. The option granted to Mr. Burke vests as to 1/36th per month over the following 36 months from the date of grant of such stock options, subject to the individual's continued service through suchthe applicable vesting date. Additionally, in August 2015, our boardEach RSU award granted at the 2016 Annual Meeting of directors approved an option grant to purchase 14,067 shares of our common stock to Mr. Burke. The option has an exercise price of $11.09 per share, the fair market value of our common stock as determined by our board of directors on grant date. The option granted to Mr. Burke vestsStockholders vested as to 1/36th per month over100% of the following 36 months fromshares subject thereto 30 days after the date of grant of such RSUs, subject to the individual's continued service through the applicable vesting date.

The grant date fair value of all equity awards granted under our outside director compensation policy is determined in accordance with accounting principles generally accepted in the United States of America.

Any award granted under our outside director compensation policy will fully vest in the event of a change in control, as defined in our 2015 Plan, provided that the individual remains a director through such date.

-17-

-14-

Director Compensation Table |

The following table sets forth a summary of the compensation received by our non-employee directors who received compensation during our fiscal year ended December 31, 2015:2016:

Name | Fees Earned or Paid in Cash ($) | Option Awards ($) (1) | Total ($) | |||||||||

Gregory B. Brown, M.D.(2) | $ | 43,836 | $ | — | $ | 43,836 | ||||||

William W. Burke | $ | 38,356 | $ | 301,167 | $ | 339,523 | ||||||

Randall A. Lipps | $ | 33,699 | $ | 7,483 | $ | 41,182 | ||||||

Gregory T. Lucier | $ | 39,178 | $ | 16,235 | $ | 55,413 | ||||||

Eric W. Roberts | $ | 36,986 | $ | 43,291 | $ | 80,277 | ||||||

Reza Zadno, Ph.D. | $ | 35,069 | $ | — | $ | 35,069 | ||||||

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option Awards ($)(1) | Total ($) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

William Burke | $ | 82,500 | $ | 62,336 | $ | 62,438 | $ | 207,274 | |||||

Randall Lipps | $ | 71,500 | $ | 62,336 | $ | 62,438 | $ | 196,274 | |||||

Gregory Lucier | $ | 55,000 | $ | 62,336 | $ | 62,438 | $ | 179,774 | |||||

Eric Roberts | $ | 67,500 | $ | 62,336 | $ | 62,438 | $ | 192,274 | |||||

Reza Zadno, Ph.D. | $ | 64,000 | $ | 62,336 | $ | 62,438 | $ | 188,774 | |||||

The aggregate number of shares subject to outstanding stock awards and stock option awards for each of our non-employee directors as of December 31, 20152016 was:

| Name | Aggregate Number of Option Shares (#) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

-18-

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2016.2017. Although not required by applicable law, or our amended and restated certificate of incorporation or amended and restated bylaws, as a matter of good corporate governance, we are asking our stockholders to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accountants. PricewaterhouseCoopers LLP has audited our financial statements since 2010.

We expect that representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting, and will be available to respond to appropriate questions from stockholders. Additionally, the representatives of PricewaterhouseCoopers LLP will have an opportunity to make a statement if they so desire.

The affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the appointment of PricewaterhouseCoopers LLP. Abstentions will be counted toward the tabulation of votes cast on this proposalProposal and will have the same effect as a vote against the proposal. Broker non-votes will be counted toward a quorum but not counted for any purpose in determining whether this proposalProposal has been approved.

If our stockholders fail to ratify the appointment of PricewaterhouseCoopers LLP, our audit committee will reconsider whether to retain the firm. Even if the selection is ratified, our audit committee in its discretion may direct the appointment of different independent registered public accountants at any time during the year if it determines that such a change would be in our best interests and the best interests of our stockholders.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A "FOR" VOTE FOR THIS PROPOSAL

|

Audit and All Other Fees |

The following table represents aggregate fees billed to us for services related to the fiscal years ended December 31, 20152016 and 20142015 by PricewaterhouseCoopers LLP.

| 2015 | 2014 | |||||||

Audit Fees (1) | $ | 1,906,250 | $ | 494,348 | ||||

Audit-Related Fees (2) | — | — | ||||||

Tax Fees (3) | — | $ | 25,000 | |||||

All Other Fees (4) | $ | 1,800 | $ | 1,800 | ||||

|

|

|

| |||||

| $ | 1,908,050 | $ | 521,148 | |||||

|

|

|

| |||||

| | 2016 | 2015 | |||||

|---|---|---|---|---|---|---|---|

Audit Fees(1) | $ | 956,250 | $ | 1,906,250 | |||

Audit-Related Fees | — | — | |||||

Tax Fees | — | $ | — | ||||

All Other Fees(2) | $ | 2,970 | $ | 1,800 | |||

| | | | | | | | |

| $ | 959,220 | $ | 1,908,050 | ||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Our audit committee has considered whether the provision of non-audit services is compatible with maintaining the independence of PricewaterhouseCoopers LLP, and has concluded that the provision of such services is compatible with maintaining the independence of our auditors.

-19-

Audit Committee Pre-Approval Policies and Procedures

Audit Committee Pre-Approval Policies and Procedures |

The audit committee, or the chair of the audit committee, must pre-approve any audit and non-audit service provided to the Company by the independent auditor, unless the engagement is entered into pursuant to appropriate preapproval policies established by the Committee or if such service falls within available exceptions under SEC rules. In fiscal

years 20142015 and 2015,2016, all fees identified above under the captions “Audit"Audit Fees,” “Audit-Related" "Audit-Related Fees,” “Tax" "Tax Fees,”" and “All"All Other Fees”Fees" that were billed by PricewaterhouseCoopers LLP were approved by the audit committee in accordance with SEC requirements.

-20-

The audit committee oversees our financial reporting process on behalf of the Company’sCompany's board of directors, but management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed and discussed the audited financial statements in the Company’sCompany's Annual Report on Form 10-K for the year ended December 31, 20152016 with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting initiatives.

The audit committee reviewed and discussed with PricewaterhouseCoopers LLP, which is responsible for expressing an opinion on the conformity of the Company’sCompany's audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the Company’sCompany's accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards, including Auditing Standard No. 16, “Communication1301, "Communication with Audit Committees” (which superseded Statement on Auditing Standards No. 61 for fiscal years beginning after December 15, 2012) of the Public Company Accounting Oversight Board.Committees". In addition, the audit committee has discussed with PricewaterhouseCoopers LLP, its independence from management and the Company, has received from PricewaterhouseCoopers LLP the written disclosures and the letter required by Public Company Accounting Oversight Board Rule 3526 (Independence Discussions with Audit Committees), and has considered the compatibility of non-audit services with the auditors’auditors' independence.

We have met with PricewaterhouseCoopers LLP to discuss the overall scope of its services, the results of its audit and reviews, its evaluation of the Company’s internal controls and the overall quality of the Company’sCompany's financial reporting. PricewaterhouseCoopers LLP, as the Company’sCompany's independent registered public accounting firm, also periodically updates the audit committee about new accounting developments and their potential impact on the Company’sCompany's reporting. Our meetings with PricewaterhouseCoopers LLP were held with and without management present. Members of the audit committee are not employed by the Company, nor does the audit committee provide any expert assurance or professional certification regarding the Company’sCompany's financial statements. We rely, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the Company’sCompany's independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, we recommended to the board of directors that the audited financial statements be included in the Company’sCompany's Annual Report on Form 10-K for the year ended December 31, 2015.2016. We and the Company’sCompany's board of directors also recommended, subject to stockholder approval, the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’sCompany's independent registered public accounting firm for the fiscal year ending December 31, 2016.2017.

This report of the audit committee shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

Respectfully submitted,

AUDIT COMMITTEE

William W. Burke, Chairman

Eric W. Roberts

Reza Zadno, Ph.D.

This Audit Committee Report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

-21-

Our executive officers, and their respective ages and positions with us as of April 1, 2016,15, 2017, are as follows:

| Name | Age | Position | ||

|---|---|---|---|---|

|

|

| ||

| President, Chief Executive Officer and Director | |||

James | Chief Financial Officer | |||

| Senior Vice President of Global Sales | |||

Paul | Vice President of Research and Development | |||

Doug Heigel | Vice President of Operations | |||

Alex Vayser | Chief Technology Officer and Co-Founder | |||

| Vice President of | |||

Joseph Guido | Vice President of Business Development |

Mr. Sawyer’sSawyer's biography can be found under the heading “Proposal 1—section titled "Proposal 1: Election of Directors.”Directors—Members of the Board of Directors Continuing in Office".

James H. Mackaness has served as our Chief Financial Officer since August 2015. Prior to joining us, Mr. Mackaness served as Chief Financial Officer and Chief Operating Officer of IRIDEX Corporation, a medical supplydevice company, from August 2012 to August 2015 and as Chief Financial Officer from Jan 2008 to August 2012. From September 2001 to December 2007, Mr. Mackaness served as Chief Financial Officer and Vice President of Finance of NextHop Technologies, Inc., a networking wireless technology company. Prior to that, Mr. Mackaness served as Vice President, Finance and Chief Financial Officer and Vice President of Finance of Infogear Technologies Corporation and held management positions at Cisco Systems, Inc., Electroglas, Inc. and Ernst & Young LLP. Mr. Mackaness received a B.A. with honors in Psychology from the University of Warwick, England and is a Chartered Accountant and member of the Institute of Chartered Accountants of England and Wales.

Robert GerberichAndrew Sale has served as our Vice President of Sales since May 2015 and Vice President of Sales and Marketing from October 2012 to May 2015. From April 2012 to October 2012, Mr. Gerberich served as Senior Vice President of Global Sales and Field Development at Primcogent Solutions, a non-invasive low-level laser therapy company. Fromsince January 2006of 2017. Prior to April 2012,joining us, Mr. GerberichSale served as Vice President at Alpha Genomix Laboratories from August 2015 to June 2016. From April 2004 to December 2014, Mr. Sale served in a variety of UltraShape North America.roles at Intuitive Surgical, a publicly traded manufacturer of robotic surgical systems, including Sales Manager, Sales Director, Area Vice President, Regional Vice President and in his last role was responsible for all the U.S. capital business. Prior to UltraShape,Intuitive Surgical, Mr. Gerberich served asSale spent six years at Johnson & Johnson, where he provided sales and sales leadership in key specialty companies inside of Ethicon to drive the Vice Presidentgrowth of Marketing and Sales and Vice President of Sales at Thermage Inc., a medical device company (now Solta Medical).emerging products. Mr. GerberichSale received a B.S.B.A. in marketingGeneral Studies from IllinoisLouisiana State University.

Paul O. Davison has served as our Vice President of Research and Development since November 2014. From OctoberSeptember 2011 to November 2014, Mr. Davison served as Vice President and General Manager, Advanced Energy at ConMed Corporation, a surgical and patient monitoring products company. From JulyJune 2006 to SeptemberAugust 2011, Mr. Davison served as Vice President of Research and Development at PEAK Surgical, a surgical tools company acquired by Medtronic, Inc. in 2011. Mr. Davison received a B.S. in manufacturing engineering from California State Polytechnic University at Pomona and an M.S. in engineering management, with a stem in mechanical engineering stem from Santa Clara University.

Doug Heigel has served as our Vice President of Operations since September 2014. From July 2003 to January 2014, Mr. Heigel served as Vice President of Operations for Solta Medical, a medical aesthetics company which was sold to Valeant Pharmaceuticals in January 2014. In May 2002, Mr. Heigel joined Solta Medical’sMedical's predecessor company, Thermage, as Senior Director of Operations. From October 1995 to February 2002, Mr. Heigel worked for Argonaut Technologies, a life sciences company, first as Director of Manufacturing and then as Vice President of Manufacturing. Prior to Argonaut, Mr. Heigel served in various operational and technical leadership roles in the semiconductor and measurement instrumentation markets. Mr. Heigel received a B.S. in mechanical engineering from Oregon State University.

Alex Vayser co-founded Invuity and has served as our Chief Technology Officer since November 2004. Prior to joining Invuity, Mr. Vayser co-founded and served as President of Medvision, a manufacturer of custom surgical

-22-

endoscopes and imaging devices. While at Medvision, Mr. Vayser co-founded Parallax Devices, a company focused on single channel

-19-

stereoscopic and 3-D optical systems for medical and industrial applications. Mr. Vayser received a B.S. in optical engineering from the University of Rochester’sRochester's Institute of Optics.

Susan MartinSteven Annen has served as our Vice President of MarketingProduct Management and Strategy since May 2015.April 2016. He joined the Company in November 2015 as Senior Director, Product Management and Strategy. From February 2011January 2014 to August 2014, Ms. MartinOctober 2015, Mr. Annen served as the Vice President of GlobalMarketing for Grabit, Inc., a material handling technology provider. From October 2005 to January 2014, Mr. Annen served as the Director of Product Marketing at Zimmer Holdings,Intuitive Surgical Inc., a medical device company. From 2009publicly traded manufacturer of robotic surgical systems. Prior to 2011, Ms. Martin served as Executive Director of Global Marketing at Ethicon,Intuitive Surgical, Mr. Annen held leadership roles in public sector companies including Veeco Instruments, Inc., a subsidiarypublicly traded provider of Johnson & Johnson focused on surgical products. Prior to her role as Executive Directorprocess equipment technology, and Adept Technology Inc., a publicly traded provider of Global Marketing at Ethicon, Inc., Ms. Martin served in various roles at Ethicon, Inc. from 2001-2009, including Executive Director, General Managerintelligent vision-guided robotics systems and Integration Lead and Executive Director of Procedure Marketing. Ms. Martinservices. Mr. Annen received

a his B.S. in Business Administrationmechanical engineering from Bowling Green State University.Rutgers University and his M.S. in mechanical engineering from the University of Wisconsin, Madison.

Joseph Guido has served as our Vice President of Business Development since February 2016. From 2012 to 2016, Mr. Guido served as Senior Vice President of Marketing and Business Development for Hansen Medical, a publicly-traded robotics company in the vascular and cardiac sectors. Prior to joining Hansen Medical, Mr. Guido served as the President of Heartstitch Medical, a medical devices company, in 2011. Prior to joining Heartstitch Medical, Mr. Guido held a variety of leadership roles in Marketing, Sales and Business Development for both public and private medical device companies such as Stryker Endoscopy, Intuitive Surgical, Novare Surgical and Abbott Vascular Devices. Mr. Guido received his B.S. degree in business administration from Villanova University and his M.B.A. from Pepperdine University.

-23-

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of March 1, 2016,31, 2017, except as noted in the footnotes below, for:

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Shares of common stock that may be acquired by an

individual or group within 60 days of March 1, 2016,31, 2017, pursuant to the exercise of options, warrants or other rights, are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table.

Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them, based on information provided to us by such stockholders. The address for each director and executive officer listed is: c/o Invuity, Inc., 444 De Haro Street, San Francisco, CA 94107.

Percentage of beneficial ownership is based on 13,401,08516,971,664 shares of common stock outstanding as of March 1, 2016.31, 2017.

| Beneficial Owner | Number of Shares Beneficially Owned | Percentage Beneficially Owned | |||||

|---|---|---|---|---|---|---|---|

5% or Greater Stockholders: | |||||||

Entities affiliated with HealthCare Royalty Partners II, L.P.(1) | 1,245,455 | 7.34% | |||||

Entities affiliated with InterWest Partners X, L.P.(2) | 1,080,272 | 6.37% | |||||

The Hartford Mutual Funds, Inc.(3) | 890,005 | 5.24% | |||||

Deerfield Mgmt, L.P.(4) | 1,690,498 | 9.96% | |||||

Novo A/S(5) | 1,318,448 | 7.77% | |||||

Directors and Named Executive Officers: | |||||||

Philip Sawyer(6) | 793,278 | 4.52% | |||||

James Mackaness(7) | 54,826 | * | |||||

Robert Gerberich(8) | 101,178 | * | |||||

William Burke(9) | 94,212 | * | |||||

Randall Lipps(10) | 74,070 | * | |||||

Gregory Lucier(11) | 110,908 | * | |||||

Eric Roberts(12) | 134,239 | * | |||||

Reza Zadno, Ph.D.(13) | 41,700 | * | |||||

All directors and executive officers as a group (14 individuals)(14) | 1,919,599 | 10.50% | |||||

-24-

Beneficial Owner | Number of Shares Beneficially Owned | Percentage Beneficially Owned | ||||||

5% or Greater Stockholders: | ||||||||

Entities affiliated with the Wellington Entities (1) | 1,876,490 | 14.00% | ||||||

Entities affiliated with HealthCare Royalty Partners II, L.P. (2) | 1,245,455 | 9.23% | ||||||

Entities affiliated with InterWest Partners X, L.P. (3) | 1,080,272 | 8.06% | ||||||

Entities Affiliated with FMR LLC (4) | 1,657,800 | 12.37% | ||||||

Deerfield Mgmt, L.P. (5) | 1,078,218 | 8.05% | ||||||

Novo A/S (6) | 925,000 | 6.90% | ||||||

Directors and Named Executive Officers: | ||||||||

Philip Sawyer (7) | 812,235 | 5.80% | ||||||

James H. Mackaness | — | — | ||||||

Susan Martin (8) | 91,328 | * | ||||||

William W. Burke (9) | 47,432 | * | ||||||

Randall A. Lipps (10) | 31,857 | * | ||||||

Gregory T. Lucier (11) | 46,947 | * | ||||||

Eric W. Roberts (12) | 401,041 | 2.99% | ||||||

Reza Zadno, Ph.D. | — | — | ||||||

All directors and executive officers as a group (13 individuals) | 2,015,542 | 13.84% | ||||||

-22-

-23-

The following is a discussion and analysis of compensation arrangements of our named executive officers. This discussion contains forward looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. Actual compensation programs that we adopt may differ materially from currently planned programs as summarized in this discussion. As an “emerging"emerging growth company”company" as defined in the JOBS Act, we are not required to include a Compensation Discussion and Analysis and have elected to comply with the scaled disclosure requirements applicable to emerging growth companies.

Processes and Procedures for Compensation Decisions

Processes and Procedures for Compensation Decisions |

Our compensation committee is responsible for the executive compensation programs for our executive officers and reports to our board of directors on its discussions, decisions and other actions. The salary and bonuses paid to our executive officers are reviewed annually by the compensation committee. Typically, our Chief Executive Officer makes recommendations to our compensation committee, often attends committee meetings and is involved in the determination of compensation for the respective executive officers who report to him, except that the Chief Executive Officer does not make recommendations as to his own compensation. Our Chief Executive Officer makes recommendations to our compensation committee regarding short- and long-term compensation for all executive officers (other than himself) based on our results, an individual executive officer’sofficer's contribution toward these results and performance toward individual goal achievement. Our compensation committee then reviews the recommendations and other data and makes decisions as to total compensation for each executive officer other than the Chief Executive Officer, as well as each individual compensation component. Our compensation committee makes recommendations to our board of directors regarding compensation for the Chief Executive Officer. Our Chief Executive Officer recuses himself from compensation committee and board discussions when his compensation is reviewed. The independent members of our board of directors make the final decisions regarding executive compensation for the Chief Executive Officer. In addition, as necessary, the Chief Financial Officer attends compensation committee meetings to discuss and review our form of compensation and compensation programs and strategy.

Our compensation committee is authorized to retain the services of one or more executive compensation advisors, as it sees fit, in connection with the establishment of our compensation programs and related policies. In January 2015,February 2016, the compensation committee approved the appointment of Compensia, Inc., an independent compensation consultant, to advise us on compensation philosophy as we transitioned to becoming a publicly traded company, selection of a group of peer companies to use for compensation benchmarking purposes and cash and equity compensation levels for our directors, executives and other employees based on current market practices. Compensia, Inc. serves at the discretion of the compensation committee and did not provide any other services to us in 2015.2016.

Named Executive Officers |

Our "Named Executive Officers

Our “named executive officers”Officers" include our principal executive officer and the next two most highly compensated executive officers. For 2015,2016, our named executive officersNamed Executive Officers were:

Philip Sawyer, who currently serves as our President and Chief Executive Officer, as well as a member of our board of directors;

Susan Martin, who currently serves as our Vice President of Marketing; and

James H. Mackaness, who currently serves as our Chief Financial Officer.Officer; and

On April 5, 2016, it was determined that Susan Martin,Robert Gerberich, who served as our Vice President of Marketing, would be leaving the Company effective April 19,Sales through December 31, 2016. See “Executive Officer "—Employment, Agreements & Offer Letters”Change of Control and Severance Agreements" below for further discussion.

-27-

Fiscal 2015 Summary Compensation Table

Fiscal 2016 Summary Compensation Table |